Good students of digital technology, why telecom operators are crying out for injustice

It is a ritual in the run-up to the end-of-year holidays. The French Telecom Federation (FFT) publishes its study on the economy of the telecom sector in France. The opportunity for operators to raise their laurels while seeking to defend – figures to support – their interests. Carried out by the Arthur D. Little firm, this 2023 edition takes up more or less the diagnosis established last year.

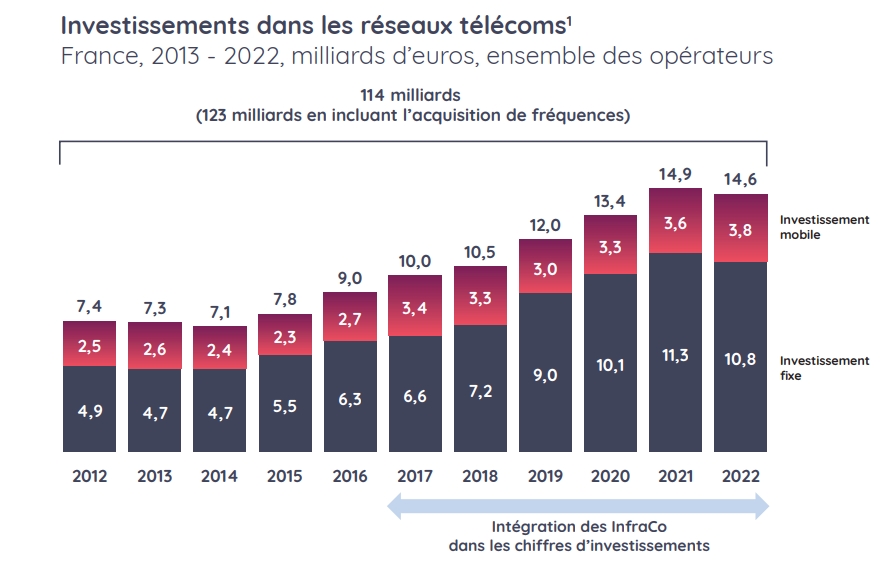

If the investments made in telecom networks have slightly decreased – 14.6 billion euros in 2022 against 14.9 billion in 2021 – they remain at particularly high levels and without common measure compared to those made by other infrastructure operators. Networks in telecommunications require investments twice as high as transmission networks and electricity distribution or the railway network.

This investment effort, which corresponds to almost 20% of the operators’ turnover, has made it possible to connect more than 84% of the premises to fiber. With more than 23.9 million households eligible for superfast broadband, France would be at the top of European countries, far ahead of Germany and the United Kingdom. If 44,300 5G sites cover the territory, the adoption of very high mobile broadband is slower with 9 million active 5G SIM cards.

Rates among the lowest in Europe

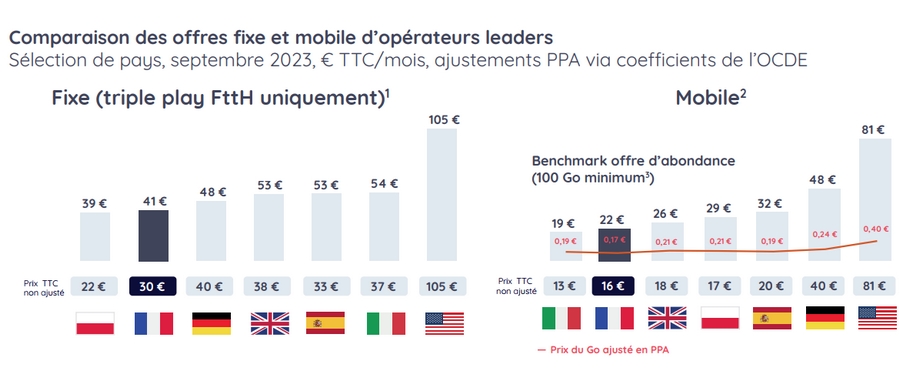

Despite these heavy investments that weigh on their indebtedness and the inflationary context, operators would maintain very competitive prices. Not taking into account the tariff increases that occurred in 2023, the study notes that the telecom sector is the only one to have lowered its prices in the long term and thus returned purchasing power to the French. In ten years, the weight of telecoms has even decreased in the household budget, from 1.7% in 2013 to 1.4% in 2022.

Here again, France would be a good student by displaying the tariffs among the lowest of the major Western countries. The average amount of a fixed “triple play” offer amounts to 41 euros against 53 euros across the Channel or 54 euros in Italy. In the mobile, it is at 22 euros against 32 euros in Spain and 48 euros in Germany.

Operators are keeping prices low while they say they are being knocked out by ” significantly heavier taxation “than other digital players. They are in fact subject to specific taxes such as the flat-rate Tax on network companies (Ifer), i.e. 300 million euros collected for the benefit of local authorities. In total, ” operators pay 1.9 times more taxes than the average CAC 40 company while they invest three times more ».

Telecom operators only receive 39% of French digital revenues

Decidedly plaintive, the sector denounces an imbalance in the sharing of value between operators and other digital players such as terminal manufacturers or web giants. Telecom operators receive only 39% of the total revenues of the French digital ecosystem (compared to 44% in 2019), but ensure 79% of investments, 66% of jobs and pay 83% of taxes and taxes.

Revenues from the global digital ecosystem grew by 9% in 2022 compared to 3% for operators. « This low revenue growth of European operators explains their market valuation twice lower on average than that of other operators”, the study specifies.

The return of the GAFAM tax

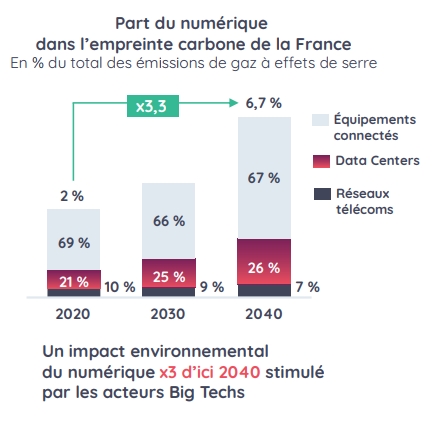

Not only GAFAMS and OTT (Over The Top) platforms grab most of the value but also of the bandwidth. During rush hour, 80% of French traffic is generated by five Internet players, in this case Google, Netflix, Meta, Microsoft and Akamai. In a vicious circle, the exponential growth of digital uses forces operators to increase their capacities and “leads to increasing environmental costs”.

The study deduces that “ we must change the parameters of the digital equation in France and in Europe and set up a fair contribution to the use of networks, encouraging the largest traffic transmitters to be sober. “This GAFAM or “fair share” tax, which would be used to finance the networks they borrow, is not unanimous within the European Union.

On the environmental front, the French operators declare to have “ the most ambitious commitments in the sector, in Europe and globally. “The four indicators monitored since 2020 – reduction of direct carbon emissions, increased use of renewable energies, development of the sale of refurbished phones and recycling of collected phones – are all progressing in the right direction.

While the carbon footprint of digital technology is expected to more than triple with the multiplication of uses between 2020 and 2040, the share of telecom networks in this digital footprint will increase over the same period from 10% to 7%.