Smartphones: the market is recovering led by Chinese brands

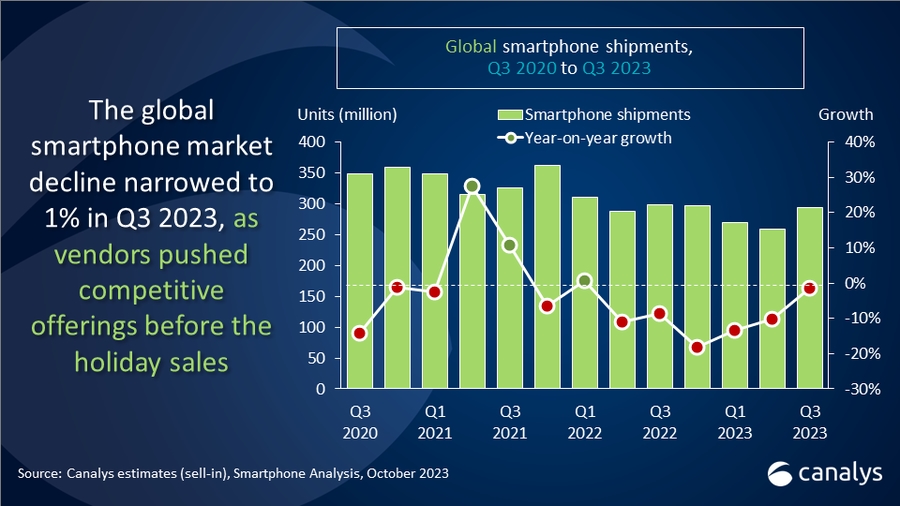

The smartphone market is recovering. While 2023 was announced as the worst year for mobile phone sales, the results of the third quarter suggest a return to growth faster than expected. According to the latest study by the Canalys firm, the global market has contracted by only 1% to reach 294.6 million units sold.

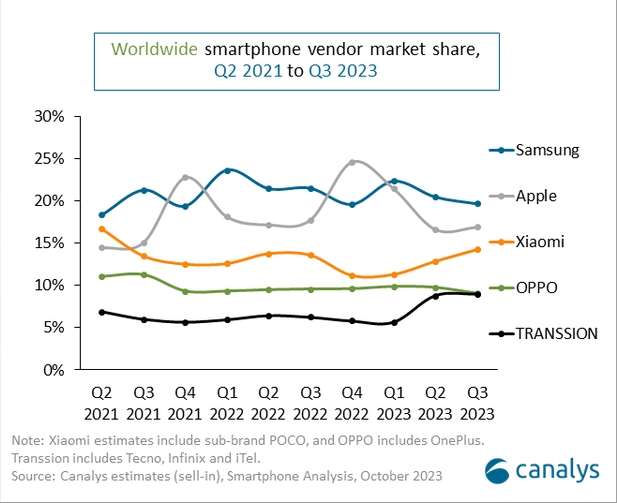

The market is boosted by the release of new models including Apple’s iPhone 15 and Samsung’s Galaxy Z Flip and Fold 5 series. However, the two leading brands are not completely taking advantage of the beautification. If Samsung retains the pole position with 20% of market share, its sales fall by 9% in a year. Solid second with 17% of market share, Apple sees, for its part, its sales decline by 6% over the last twelve months.

Transsion, a new entrant from China (again)

Behind the American and the Korean, the Chinese manufacturers are putting pressure. Xiaomi, including its sub-brand POCO, consolidates its third place with an increase in sales of its smartphones by 2% over the year. A growth that Canalys puts on the account of the success of the launch of the Redmi economic series in emerging markets.

Oppo, which is experiencing setbacks on the French market, occupies the fourth place, integrating its other OnePlus brand, despite an 8% drop in sales with 9% of market share. Another Chinese brand, unknown in Europe, is playing an equal game with Oppo by recording a meteoric increase of 40% in one year. Transsion, a holding company bringing together the Tecno, Infinix and iTel brands, sold 26 million units worldwide in the third quarter.

Founded in 2006 in Hong Kong and now based in Shenzhen, Transsion is the most important smartphone manufacturer on the African market where it has established a factory in Ethiopia. The group is also firmly established in India, Pakistan and Bangladesh, in the Middle East while expanding its presence in Latin America. Its goal: to become the most popular brand in emerging markets.

The foldable market is not yet folded

To differentiate themselves and play the margin card more than market share, established brands are positioning themselves on the high-end and in particular on the new foldable smartphone segment. Opening this market in 2019, Samsung launched this summer the 5 versions of its Galaxy Z Fold and Galaxy Flip. Huawei, Xiaomi, Oppo and even Google have since also introduced foldable models.

On the Apple side, the support for USB-C and the arrival of Dynamic display (Dynamic Island) boosted its sales. To compete with the iOS world,” Android brands are striving to improve the integration of their ecosystem to seduce consumers”, observes Canalys. This leads some Chinese brands to develop their own operating systems such as Huawei’s HarmonyOS and Xaomi’s HyperOS.

“These internal operating systems should open up new revenue opportunities beyond smartphones, for example through IoT and electric vehicles “, estimates the research firm. He recalls that maintaining a competitive advantage and the interest of users nevertheless presupposes dedicating significant investments in R &D.

What about 2024? Canalys expects the global smartphone market to return to modest growth next year. After having destocked a lot in recent months, manufacturers should close 2023 with more balanced stock levels. However, regional conflicts and geopolitical tensions may affect certain geographies. Manufacturers to adapt their strategies to seize growth opportunities where they are, concludes the study.