TV advertising: where do advertisers go?

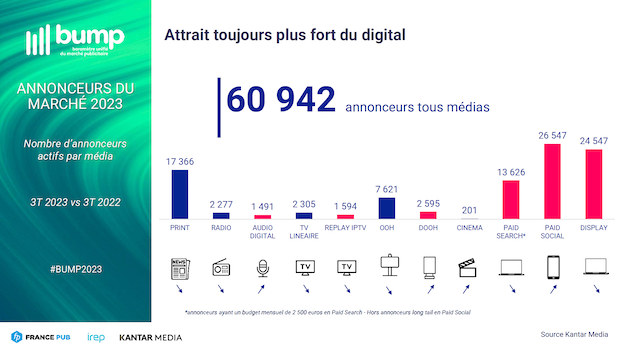

The BUMP study identifies nearly 61,000 advertisers in France across all media. TV advertisers account for 3.8% of total advertisers, but 20% of TV channels’ advertising revenues. In addition to their traditional advertisers, TV channels are also betting on digital advertising via their replay services with nearly 1,600 advertisers. But this figure remains very far from the level reached by conventional digital advertising formats, which exceeds 24,500 advertisers for display and 26,500 advertisers for paid social.

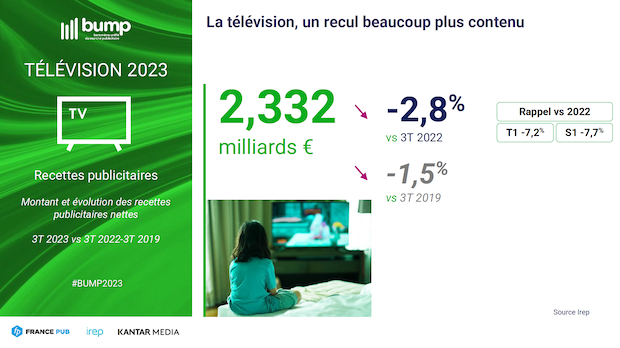

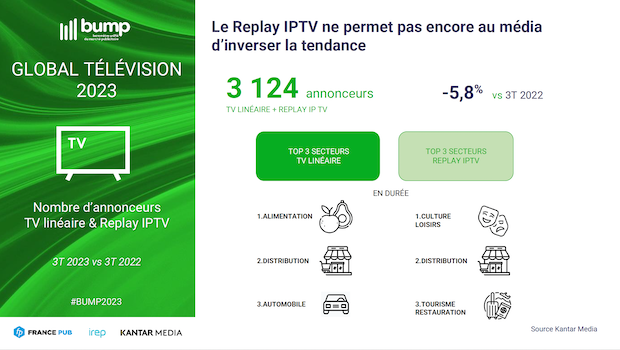

According to data published at the end of September 2023, the portfolio of TV advertisers is down by 6.8% on average, with a more pronounced decline on national channels. In total, the TV channels represent a portfolio of 3,124 advertisers, a total decrease of 5.8%.

Beyond the fact that advertisers are moving more and more towards buying space at CPM in digital, the growing phenomenon of FAST channels and AVOD offers is positioning itself in competition with linear television. The global advertising revenue forecasts for AVOD and FAST are giving a whirl and making these new formats the new el dorado of studios and television channels. The presence of Netflix, Disney + and others on this market, with displayed CPMs that amount to tens of dollars, are gradually diverting some advertisers from broadcast advertising. In these conditions, we better understand the strategy of several TV channels to bet on all-round streaming in order to maximize the exposure of their programs, live, replay, AVOD and FAST. Nothing revolutionary, just the natural hunt for the audience and advertisers.

While waiting for the general standardization of video advertising, putting an end to the GRP/CPM confrontation, the risk of classic channels still losing ground is possible.