Results: Bouygues Telecom on a small cloud

SFR crying, Bouygues Telecom laughing. The two enemy operators have decidedly their destinies linked. While the Altice subsidiary, caught up in the turmoil of the Pereira affair, is losing subscribers, that of the Bouygues group is expanding its portfolio.

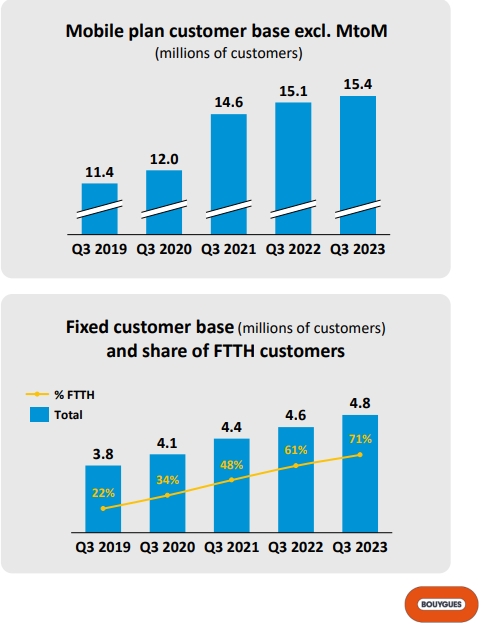

During the first nine months of 2023, Bouygues Telecom acquired 217,000 new mobile customers, including 108,000 in the third quarter alone. He has 15.4 million subscribers on his mobile networks.

Same trend in fixed. The operator has attracted 425,000 new fiber optic subscribers since the beginning of the year, including 154,000 in the third quarter. The fixed-line customer base reaches 4.8 million subscribers, 71% of whom have chosen a fiber offer. And their number is expected to grow even more in the coming months. Bouygues Telecom is deploying fiber at a steady pace with a fleet of more than 33 million FTTH sockets and a target of 35 million sockets by the end of 2026.

New subscribers that Bouygues Telecom has taken, according to the principle of communicating vessels, partly at SFR. Over the first six months of the year, the latter has, in fact, lost 235,000 net subscribers on mobile and 41,000 on landline tells us The Echoes.

An average revenue per subscriber on the rise

While the inflationary context is leading operators to raise the prices of their mobile packages and their internet access offers at the risk of losing customers, Bouygues Telecom seems to have maneuvered deftly. The average revenue per subscriber has not only maintained but is increasing. This ARPU (Average Revenue Per User) increases in the mobile by ten cents to 19.8 euros per customer per month, and by 1.9 euros in the fixed at 30.9 euros per customer per month.

In an interview with France Info, Benoît Torloting, managing director of Bouygues Telecom, indicates that although the operator had to adjust its offers to take into account the inflation of its costs in energy, wages and the purchase of components, it did not pass on all of these increases in its tariffs. The latter have increased by “only” 1 to 2 euros depending on the types of offers.

The BtoB market, a growth relay

Beyond competitive prices, the boss of Bouygues Telecom insists on the quality of service, a key element of subscriber loyalty. During Arcep’s last annual survey to evaluate the quality of service of mobile operators, the operator came second, behind Orange, and, for the tenth consecutive year.

The operator also benefits from the good dynamics of its BtoB division, unlike Orange, which must lead a voluntary redundancy plan in its enterprise branch. Relying on its own fiber network, Bouygues Telecom Entreprises has recorded strong growth in its FFTH/FTTO (shared fiber /dedicated fiber) offers.

The dedicated subsidiary has also invested in the areas of private 5G and the cloud, with its own sovereign OnCloud cloud and a stake in NumSpot, a trusted cloud in which it is associated with the Banque des Territoires, Dassault Systèmes and Docaposte. He also puts a lot of hopes in the field of cybersecurity despite his position as a challenger against Orange Cyberdefense and SFR Business.

In the role of consolidator of the French market?

In total, Bouygues Telecom’s turnover increased by 3% compared to the end of September 2022 to reach 5.7 billion euros in the first nine months of the year. If the operator weighs only 14% of the Bouygues group’s turnover, it contributes to 48% of its operating profit before provisions and depreciation (Ebitda).

Could this good health lead Bouygues Telecom to play the role of consolidator on the French market? Over-indebted, Patrick Drahi, boss of the Altice empire, would be ready to sell part of the capital of SFR, its main asset in Europe. In his interview with France Info, Benoît Torloting leaves little hope that such a deal will materialize. According to him, the competition rules at European and French level would not allow a transition from four to three operators on the Hexagonal market.

Even if it seems unlikely, this rapprochement would not lack salt. In 2015, a year after having seized SFR in an epic way, the insatiable Patrick Drahi had proposed, according to the JDD, to Martin Bouygues more than 10 billion euros to buy Bouygues Telecom. Some eight years later, the roles are almost reversed.