TDF ready to sell its fiber optic networks

Cut-to-cut sales are becoming a strong trend in the telecom sector. While Patrick Drahi, founding president of Altice, is considering selling a large number of assets in order to give collateral to his creditors, Les Echos informs us that TDF is preparing to sell its fiber optic networks.

After trying to sell its telecom towers to the Swedish investment fund EQT, the shareholders of the French group – Brookfield, PSP, APG and Predica – mandated BNP Paribas to find a buyer for its very high-speed networks, which it leases access to telecom operators. It is up to the latter to market them to individuals, professionals and communities.

A recent and quality network

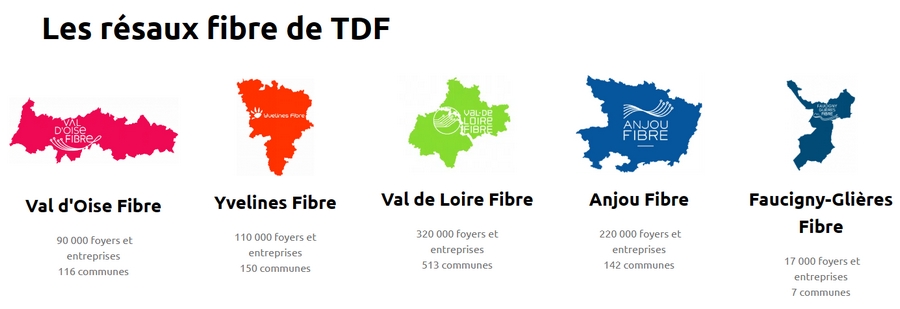

Initiated in 2017, this fiber infrastructure designed, deployed, operated and maintained by TDF includes some 765,500 sockets and serves more than 676,000 homes and businesses in sparsely populated areas. Three departments are covered – the Val d’Oise, the Yvelines, the Loire Valley -, the ancient region of Anjou and the community of communes of Faucigny-Glières, in the heart of Haute Savoie.

If this network is one of the smallest in the territory, it is both recent and of high quality. “It’s a very well-built and quality infrastructure,” says a source interviewed by Les Echos. The economic journal notes, moreover, that “the network will begin to generate stable and long-term revenues”, the bulk of the investment being made with 80% of the sockets deployed and about 40% marketed.

The strategy of diversifying its activity in the fiber sector was, in fact, a winner for TDF. The group’s 5.2% growth in 2022 is driven by telecoms. If the turnover generated by the fiber activity weighs only 51.8 million euros – less than 7% of the total group -, it is up by 42.8%. According to Les Echos, the decision to sell did not necessarily have the favor of the management who had to get behind the opinion of the shareholders.

Three candidates for the takeover

Among the candidates for the takeover, we would find Orange Concessions. This subsidiary of the incumbent operator, dedicated to Public Initiative Networks (PIPS), operates infrastructures located in rural areas and supported by local authorities. The takeover of TDF’s network would therefore make sense. Orange also knows the house. He was the owner of TDF before exiting his capital in 2004.

Les Echos cite two other applicants. The third largest optical fiber infrastructure operator in France, Altitude Infra has more than 5 million contracted outlets. Its networks cover 29 departments. The latest contender, Vauban Infrastructure Partners has teamed up with Bouygues Telecom to accelerate the generalization of fiber in medium-density (AMII /AMEL) and low-density (RIP) areas. Objective: to deploy approximately 20 million sockets by 2027.

While the sale of the fiber networks seems to be well underway, the transfer of 45% of TDF’s capital to the Swedish investment fund EQT, on the other hand, has not yet been successful according to Les Echos. The sale of the 19,600 sites of the French operator for more than 8 billion euros would be on “forced pause”, due to the financing difficulties of the buyer.

If the sale of its telecom assets ends up being successful, TDF will only retain its historical business, the “broadcast” is the broadcasting of television and radio. The group has taken the turn of Digital Terrestrial Television (TNT) and, more recently, DAB+ digital radio.